06 Apr The Future of Accounting in 2021: Cloud Software, Business Saving Strategies, and WFH is Here to Stay

Business as usual is an oxymoron in the time of COVID-19. The amount of change and various processes that have occured over the last year has far exceeded anything in recent history and it has been successful. Companies have accelerated their digital strategies to do in only a few months what they had intended to do over a few years. Businesses that fail to use this opportunity to innovate are planning to fail.

Companies have restructured their entire operations: from restaurants expanding take out options and procedures, the rise of demand for cloud software, offshoring tasks and hiring more freelancers at a part-time/per project basis, looking at methods to save on utilities, and revising leasing options, are just some of the ways businesses large & small have adapted to the pandemic.

Here are four trends that we have seen coming to watch out for during these difficult times. Your business may wish to embrace these changes to remain competitive & cost-effective.

1. Remote Work

To avoid the spread of the virus, we’ve all needed to stay home and avoid going outdoors to prevent exposure. This also means not going to a crowded office and steering clear of face-to-face contact. But this doesn’t mean work must stop.The pandemic has shown us that working from home is not only possible but provides a number of advantages:

- Increased productivity – with less time & stress stuck in traffic, employees can use the time for personal activities resulting in more concentrated efforts during work hours. A rested employee is a productive employee.

- Increased employee satisfaction – the flexibility that comes with working from home has been shown to improve employee well-being.

- Reduced costs – no need for expensive floorspace, coffee expenses, and your utilities can be reduced.

Over the last twelve months, there has been a dramatic improvement in the technology to support working from home as we have seen from the word ZOOM entering our vocabulary. But upper management has been shown in the change of a work-from-home set up.

Previously, this was a privilege given to a few, select employees. Now it’s seen to benefit both the employee and employer. It’s a win-win!

2. Cloud Software

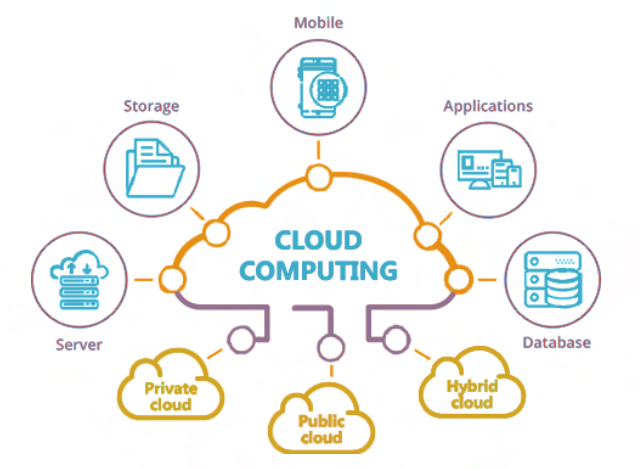

Over the last 10 years, there has been a steady progression towards “The Cloud” for provision of software.

Some benefits include:

- Reduced capital expenditure (equipment is provided by the vendor at their site)

- Reduced maintenance effort and need for support staff (the vendor looks after hardware, software and any upgrades)

- Increased security

- Flexible capacity (In times of growth, vendors can increase the resources available to you in seconds. Likewise in downtime, resources and costs can be reduced)

- The ability to work from anywhere

Those firms that have already embraced this trend were able to quickly adapt to the unique conditions over the last year. Others struggled with outdated, remote control solutions. This distracted them from being able to focus on the real business issues at hand.

From an accounting perspective, there are many vendors such as Quickbooks, Xero, MYOB and many others that offer cloud versions so you can work on your books anywhere in the world.

The price? Costs are flexible so depending on your company’s budget. There’s a plan for everyone.

3. Outsourcing Non-Strategic Tasks

Right now, most businesses need to focus on increasing revenue. A lot of small to medium enterprises (SMEs) have a disproportionate number of staff and costs associated with non-revenue producing tasks such as bookkeeping, payroll, answering phones and emails. Although important to your business, they can be a form of distraction that is not needed when you need to focus on generating sales. They are also tasks that have a tendency to suffer from capacity demands. That is, there are varying levels of staff required at different times of the year. This means there are certain months that eploy when demand is high, but have excess capacity & costs when demand is low. Have you ever felt there are times that you are not maximizing the time you pay your employees and there’s not enough work?

The concept of outsourcing non-core activities to other providers has been around for years, but it has previously been thought of as only within the domain of large enterprises. No longer is this the case. Through the advances in technology mentioned above and the change in management attitudes about where you need to be to do the job, outsourcing is now available to SMEs.

Benefits of outsourcing include:

- Access to more highly skilled workers

- Only paying for what you need

- Ability to increase or decrease capacity when required

The partner to outsourcing is offshoring. Offshoring is the same as outsourcing except the work is sent to another country. The biggest benefit is realised when choosing to offshore to a country with a much lower cost of living and therefore substantially reduced costs. Highly qualified resources can be obtained for as little as 20% of the cost in the home country.

Offshoring to places like India has been going on for over twenty years. More recently there has been a trend to move towards the Philippines due to a higher level of fluency in English and a better cultural fit. These days there are a number of firms offering accounting resources out of the Philippines for as little as a few hours a week up to dedicated teams.

This option gives you the opportunity to delegate the more mundane and repetitive tasks to a trusted outsourcer allowing you and your key local staff to focus on the key strategic issues affecting your business. Businesses may wish to embrace these changes to position themselves in a more competitive and cost effective manner.

4. Automation of accounting tasks

For years, accountants have been seen as a bunch of “bean counters” sitting in a backroom adding up figures all day long. Some of this stereotype is true as there are a lot of mundane tasks to do. Entering timesheet information for payroll, performing bank reconciliations, issuing invoices etc. But the world of technology has started to focus on changing that. Modern accounting software attempts to automate a lot of these tasks to allow your financial professionals to concentrate on analysing the data.

Direct bank feeds allow for the automation of bank reconciliations. Apps exist so employees can enter timesheets directly from their phones. Payments can be automatically scheduled. Receipts matched to invoices and payments to bills.

All of these automations result in greater accuracy and less effort for accounting staff. It also means there is more data to analyse. This opens the door for a business to truly understand its strengths, weaknesses, opportunities and threats and move to being data driven.

These are the trends that we have seen in many organisations. We predict that those businesses that adopt these will thrive through greater efficiencies and lower costs. Those that don’t may have to be fighting the dinosaurs for a place in history.

CFO Weekly, (Host). (2020, Nov). 26. The Future of Accounting in 2021: Our Top 5 Predictions w/ Megan Weis

(No. 26) [Audio podcast episode]. In Presented by Personiv.

https://open.spotify.com/episode/6FihlCBqt36OamUMxkCJT4?si=96hJprdbRfSXBchfaGdPswSchmidl, Engel. “Top Accounting Trends for 2021.” Https://Www.Intheblack.Com/, 4 Feb. 2021, www.intheblack.com/articles/2021/02/04/top-accounting-trends-2021.